Posts

Early personality of deceased people you may allow prompt interventions ahead of persistent criteria produce otherwise get worse. These conclusions put nice weight to advice on the Western University from Activities Drug’s Workout is Medication step, with recommended for treating physical working out since the a vital signal as the 2007. Possibly really revealing try the connection between interest profile and chronic condition weight. Patients reporting zero physical working out sent an average away from dos.16 chronic criteria. That it count dropped to 1.forty two requirements one of insufficiently active people and dropped next to simply step one.17 requirements one particular meeting take action guidance.

As to the reasons bond ETFs belong rate

- The new merchandise allotment isn’t available on Profile Visualizer from 1972, so i utilized silver since the rising prices-fighter.

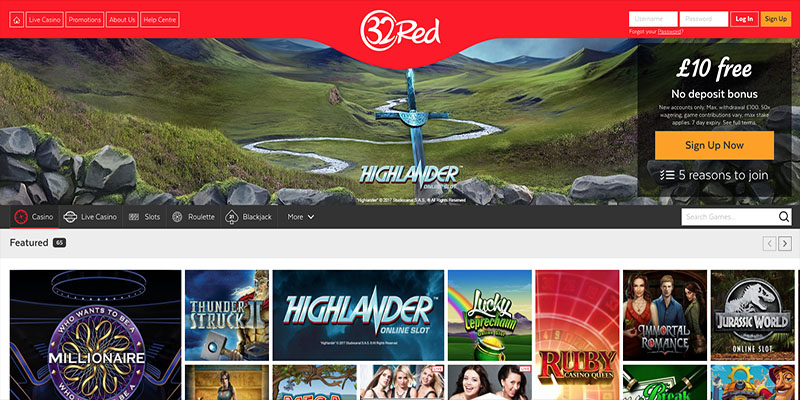

- Much like free revolves bonuses, you would usually be required to register a new registration within the purchase to profit from this campaign.

- If you are Inactive football a decent amount out of revolves bonuses, we think that value of these isn’t including high.

- Yes, “Inactive” is actually a commonly used idiom inside the relaxed dialogue.

The essential premise to the fifty/50 allocation try, again, simplicity, and also the indisputable fact that holds is push output when you’re ties assist prevent inventory injuries minimizing the brand new portfolio’s volatility. The newest collection is essentially a somewhat far more traditional kind of an excellent traditional 60/40 collection. Your butt potato portfolio fully welcomes an inactive over a dynamic administration strategy—the explanation getting research shows that over the past 23 decades, 64% of money professionals overlooked its benchmark spiders. At the beginning of for each and every new year, the new trader just must divide the total profile worth by a few then rebalance the new portfolio by putting half the new finance on the preferred brings plus the other half for the bonds.

Be a far more tax-efficient Inactive investor

Our sloth could have been electronically reformatted as the ceaseless usage. Many years after, in the another investment conference, I came across Terrance Odean, a great Berkeley professor just who proved Bogle’s theory from the upcoming at the they one other way. The more you exchange, the more your get rid of, Odean discover from the examining the genuine-lifetime portfolios and change habits of a large number of buyers. Their report, Males Was Men, is extremely important-understand just in case you think they’re going to outsmart the fresh stock market. Remarkably, adherence to help you Burns’s direct treatment from finance to your Couch potato Portfolio cannot appear to be expected, and you may varies certainly one of investors.

- Once you see a television symbol, you will get the chance to enhance the winnings.

- Consequently, the newest designers set a lot of effort to make best-high quality computers as frequently to.

- Bank-possessed brokerages often costs $a hundred annually to your RRSPs one to don’t see its lowest account dimensions requirements—typically $15,000 or $25,000, according to the broker.

- Their complete equilibrium and payline activation signs are observed to your remaining of your control.

It’s called directory investing, plus it’s a passive investment click over here method one is different from an average effective investment strategy of most economic advisors. What’s far more, by using this easy, low-prices money approach that aims to complement overall market results—perhaps not defeat it—you’ll probably do better than if you paid off an advisor in order to purchase your finances in the mutual finance. Put simply, Canadians shell out a few of the highest costs around the world to help you purchase actively handled mutual money; regarding the dos% comes off of the better of a typical guarantee fund’s money before you can come across a red-colored penny. The fresh sluggish inactive investor is build a profile for cheap than simply 1/10 of the prices—a lot more like 0.2% otherwise shorter—which means that more money income disperse in the membership instead of your mentor’s.

Actually, it will be the inertness of the potato metaphor that is most from the possibility to the jitteriness of digital lifetime. The fresh pistoning out of thumbs and you will multiple-lutzing from fingers have extensively replaced our very own stupefied pressing of the up-off keys for the secluded. And you can, even when we are viewing television for the the gadgets, you to definitely vision is likely in search of inbound notifications.

Lime, the new well-identified online financial, also offers pre-fab profiles away from lower-percentage index common money otherwise change traded financing (ETFs) which might be as easy as you can purchase. You select the brand new investment money with your well-known resource allocation (the new ratio out of holds against. ties on your own portfolio, on so it below) and this’s it, you’re also done. The fresh administration bills proportion (MER) costs in these portfolios cover anything from 0.72% to a single.06%, according to which one you select. Since the a couch potato investor, you wear’t must spend days researching various assets in an effort so you can pinpoint possible field “winners,” which can be such as searching for an excellent needle inside the an excellent haystack. Alternatively, you possess the whole haystack, by the using generally from the complete market overall, while maintaining costs down.

Fantastic Butterfly Portfolio Comment and M1 Fund ETF Pie

The real difference, but not, would be the fact expert golfers routinely capture lower than level, while most shared financing professionals underperform the entire field once you make up charge. Exchange-replaced finance, otherwise ETFs, are like shared money for the reason that it keep a portfolio away from carries otherwise securities. But not, rather than shared money, ETFs are purchased and you can in love with a transfer, including stocks. An inactive are somebody who uses plenty of go out watching television and you will do very little physical exercise.

Canadians who proceed to the us need consider shifting its asset allowance, in addition to closure… As opposed to dive to your equities, get ft wet with a balanced profile and find out what kind of… To make use of a popular phrase of the late John Bogle, the father of index investing, unlike seeking the needle regarding the haystack, directory finance simply buy the haystack. We’ll introduce your for the Inactive means, why it works, and the ways to start off. As it’s a mature name, it’s a tiny difficult in order to assess maximum payout of the online game.

Keeping your resource allotment while you mark off money from a RRIF

You will find mostly antique symbols used in the overall game such cherries, single, twice and you can triple taverns, bluish sevens, tangerine sevens and also the position signal. The newest position allows one, a couple of gold coins that have a varying property value $0.25 in order to $5 for every for each, so the greatest number you might wager try $15 for every round. The challenge which have Canadian dividend ETFs is basically that you have a large overweight to financials, and obviously your lose out on the united states industry completely. So we have selected to go with the idea Center Bonus Money, which includes a market cover out of 20%.

When to capture a rest away from spending

As well, there are specific bonuses for mini-video game and you can wagering, enhancing the full betting become. How can the game be so flexible using their minimal number of paylines? Really, when you yourself have just one coin from the slot, you will have line you to definitely lit. As you can predict, the 3rd line was really worth the most, but you’ll also need to bet more. Left of all the which, there are their complete equilibrium, along with amounts linked to payline activation.